Despite soft market, shifting networks and PPI raise rates

The less than truckload (LTL) market continues to face soft conditions, with multiple publicly held carriers reporting declines in deliveries, tonnage and even revenues. In response, carriers remain focused on operational efficiency, stringent cost control and service quality as levers to capture share and protect yields. Common initiatives include reducing reliance on purchased transportation, automating linehaul and pickup/delivery operations, improving billing accuracy, lowering cargo claims and cutting missed pickups.

Despite this softening of LTL volumes, the reduction in capacity following Yellow’s bankruptcy continues to shape the market balance. At its peak, Yellow operated more than 300 terminals nationwide. While over 200 have since been sold through bankruptcy auctions, not all went to LTL carriers and of those that did, most are not yet operational. This ongoing lack of doors in the system has constrained network supply, even as demand has eased. The impact is evident in pricing: the LTL Producer Price Index (PPI) for long-distance freight, as reported by the Federal Reserve, rose 10% year-over-year (y/y) in August, which is the largest monthly y/y change in nearly three years.

The LTL PPI includes fuel costs and as mentioned in the September Robinson Edge Report, fuel prices increased y/y for the first time in 29 consecutive months. With difficult comparables for diesel prices expected over the next several months, further increases in diesel costs are likely. This upward pressure is expected to flow through to the LTL PPI, contributing to above-average y/y changes in 2025.

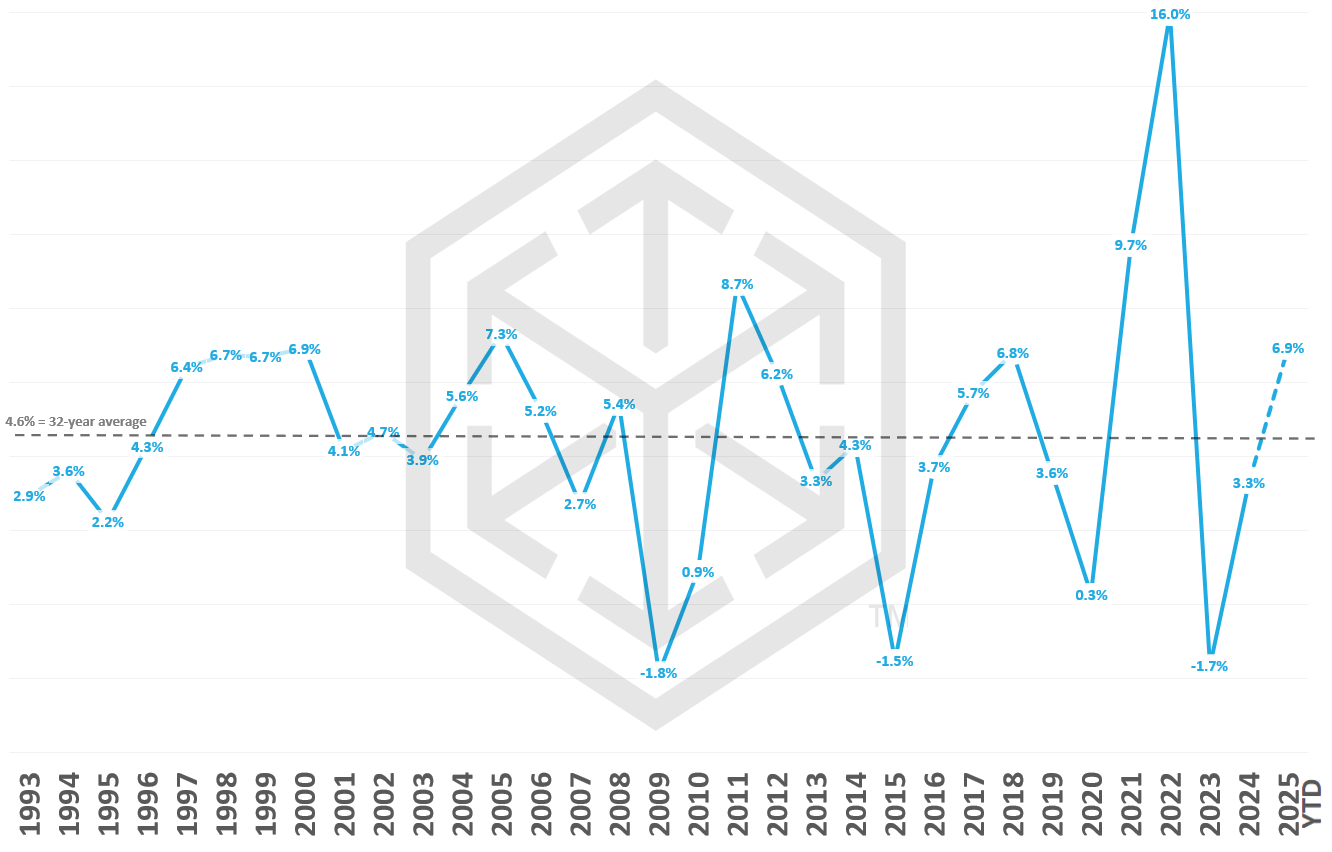

The chart below illustrates how the LTL PPI is pacing for 2025 year-to-date compared to the previous three decades of y/y changes. The grey dotted line at the centre of the chart represents the average, highlighting that 2025 is pacing to be an above-average year for PPI growth.

Long-distance LTL producer price index (PPI): Year-over-year changes

Download slides

Download slides